New financial service cybersecurity regulations with strict requirements and enforcements of current regulations are putting more pressure on you every day.

And business continuity planning is required and more critical than ever.

We specialize in federal and state regulations, including GLBA/FTC Safeguards Rule; FFIEC & state banking regulations, FDIC, and NCUA; state insurance laws; New York Department of Financial Services Part 500; SEC, FINRA; PCI-DSS - plus contractual cybersecurity obligations and cyber insurance requirements. We create business continuity plans that not only meet regulatory requirements, they work!

New financial service cybersecurity regulations with strict requirements and enforcements of current regulations are putting more pressure on you every day. And business continuity planning is required and more critical than ever.

We specialize in federal and state regulations, including GLBA/FTC Safeguards Rule; FFIEC & state banking regulations, FDIC, and NCUA; state insurance laws; New York Department of Financial Services Part 500; SEC, FINRA; PCI-DSS - plus contractual cybersecurity obligations and cyber insurance requirements.

We create business continuity plans that not only meet regulatory requirements, they work!

We have helped large and small financial service businesses licensed in all 50 states comply with all their requirements at once.

Financial service providers must meet cybersecurity compliance requirements for federal laws and regulations; all the states that license or supervise you; cyber clauses in your contracts; and your cyber insurance policy requirements.

We know that many financial services fail audits because they don't respect the difference between implementing cybersecurity and being able to pass the scrutiny of an auditor. That's why we want to help you pass whatever challenges you.

GLBA/FTC Safeguards Rule

FFIEC/FDIC/NCUA

HIPAA/HITECH

SEC/FINRA

PCI-DSS

NIST Cybersecurity Framework

State Financial Service Regulations including NY DFS 500, Insurance laws, banking regulations, etc.

State Data Breach laws

Cyber clauses in contracts

Cyber insurance policy requirements

We help:

Banks, Credit Unions

Insurance Agents, Brokers, Carriers - Property & Casualty, Cyber, Health Plans, Liability

Investment advisors/brokers

Mortgage Lenders, Payday Lenders, Car Dealers

College Financial Aid

Our business continuity plans have met the regulatory requirements for credit unions. Our incident response plans aren’t just words on paper. We take the time to identify all your compliance requirements, including those buried deep in your contracts, and your plans are exercised to ensure they will work the day you need them.

Our business continuity plans meet regulatory requirements...and have helped financial institutions survive disasters.

Federal and state regulations for financial services require tested business continuity plans. That's why our certifications and experience in business continuity planning and cyber resilience have helped financial institutions not only meet their regulatory requirements, they also worked during disasters.

We were hired by the Long Island based Bethpage Federal Credit Union (now FourLeaf Federal Credit Union), the largest credit union in New York State, to create and test a business continuity plan that met the National Credit Union Administration (NCUA) requirements.

We followed the international standards for business continuity planning and leveraged our certifications and experience as disaster survivors and in Red Cross disaster management to create and test their plan. We worked with their local health departments to develop a pandemic plan - almost 10 years before COVID. The business continuity plan was approved by the NCUA.

More importantly, it helped the 180,000 member credit union survive Superstorm Sandy, which devastated Long Island and knocked out their power for 12 days. Surviving Superstorm Sandy helped them grow from $ 4 billion to $ 14 billion in assets, offer their services nationwide, and re-brand as FourLeaf Federal Credit Union.

"WE USED THE PLAN TO SURVIVE SUPERSTORM SANDY."

"Mike Semel created and tested an extensive business continuity/pandemic response plan for our credit union, which has almost 180,000 members, 25 branches across Long Island, and over $ 4 billion in assets. We used the plan to survive Superstorm Sandy. Mike visited us and interviewed department managers, reviewed our technical infrastructure, and spoke with our county emergency management office and health department. He then mapped the plan to our NCUA compliance requirements that was approved. We were happy with the results of this engagement and recommend Semel Consulting for similar projects."

— Gary Jendras, VP of Internal Audit, Bethpage Federal Credit Union

Ready right now to talk about your needs?

Call Rose Ketchum at 888-997-3635 x 202

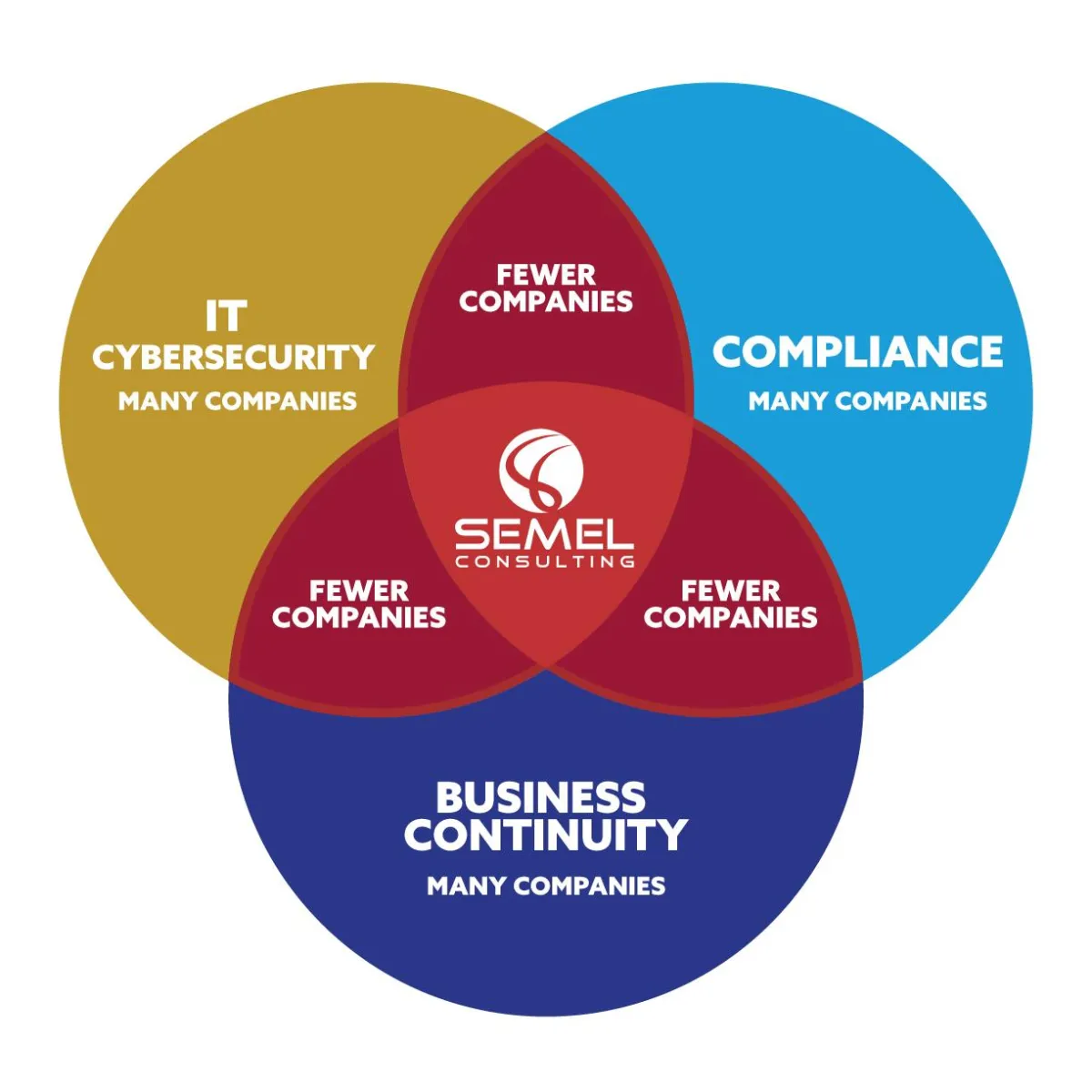

We take the Risky Guesswork out of Cybersecurity, Compliance, and Business Continuity Planning

Great cybersecurity professionals aren't always skilled in passing independent audits, incident investigations, and helping your organization win a lawsuit.

That's where we come in.

We are certified assessors, have hands-on experience passing assessments in regulated organizations, and have served as expert witnesses in cyber lawsuits.

You want that experience before it's too late.

We Help Financial Services:

Comply With Everything: Federal & State Regulations, Contracts, & Cyber Insurance

Confidentially Identify Hidden Risks

Secure Your Data

Protect The People You Serve

Protect Your Workforce Members

Protect Your Reputation

Protect Your Finances

So You Can Focus On Your Mission

FREE CHECKLIST!

Disaster Recovery Checklist

There’s no longer a ‘disaster season’. Records are being set in all categories. Insurance companies are pulling out of disaster-prone states.

Protect your business.

Mike Semel's Current Compliance & Business Continuity Certifications

CONTACT

Phone: 888-997-3635

Fax:888-667-7849

Semel Consulting, LLC

6547 Midnight Pass Road #90

Sarasota, Florida

34242

COMPANY

LEGAL

FOLLOW US

© 2025 Semel Consulting, LLC